40+ Slack Statistics for 2025: Usage, Growth & Revenue

Record, transcribe and summarize conversations with one click.

Since it was publicly launched in 2013, Slack has become one of the most popular workplace communication tools. Its adoption and revenue shot up during the COVID-19 pandemic when remote work became the norm. If you’re curious about this tool, I’ve listed 40+ Slack statistics you should know for 2025. They cover its growth, usage, revenue, and much more.

Slack stats (top picks)

The biggest proportion of the traffic to Slack’s website comes from the US, with 46.73 million visits across mobile and desktop.

According to GP Bullhound, Slack will reach a revenue of $4.2 billion by 2025 and capture 25% of the enterprise productivity market.

Salesforce completed its acquisition of Slack in July 2021.

A total of 12 million users spend about 90 minutes actively working on Slack every single day.

Slack’s current market share is 18.54%, with 344,940 customers. This puts it in third place after WhatsApp Business and Microsoft Office 365.

Overview of Slack’s growth and usage

The first set of statistics highlights Slack’s global user base and reach. These numbers are divided into the two sections below.

Number of active users

How many Slack active users are there, and at what scale has it grown year on year? Here are a few key numbers you should be aware of.

According to Statista, Slack is expected to have 79 million monthly active users by 2025.

According to a report on Slack’s website in 2020, this workplace communication tool had 10+ million daily active users. When Salesforce was acquired in the same period, 85k+ paid customers used the platform. This included a mix of smaller organizations with employees numbering in the tens and those with tens of thousands.

Over half of Slack’s daily active users in the same period were outside the United States, spread across 150+ countries.

Slack’s global reach

Semrush says the biggest proportion of traffic to Slack’s website comes from the United States, with 46.73 million visits across mobile and desktop devices. Here are some other statistics related to the global reach of Slack:

According to Slack, Japan was the second-biggest market in 2020 and also the fastest-growing. However, according to Semrush’s data for October 2024, Kenya has the second-highest traffic to Slack, with a total of 22.04 million visits, including mobile and desktop.

Japan comes in third with a total of 14.23 million, the Philippines in fourth place with 11.24 million, and India in fifth place with 10.21 million.

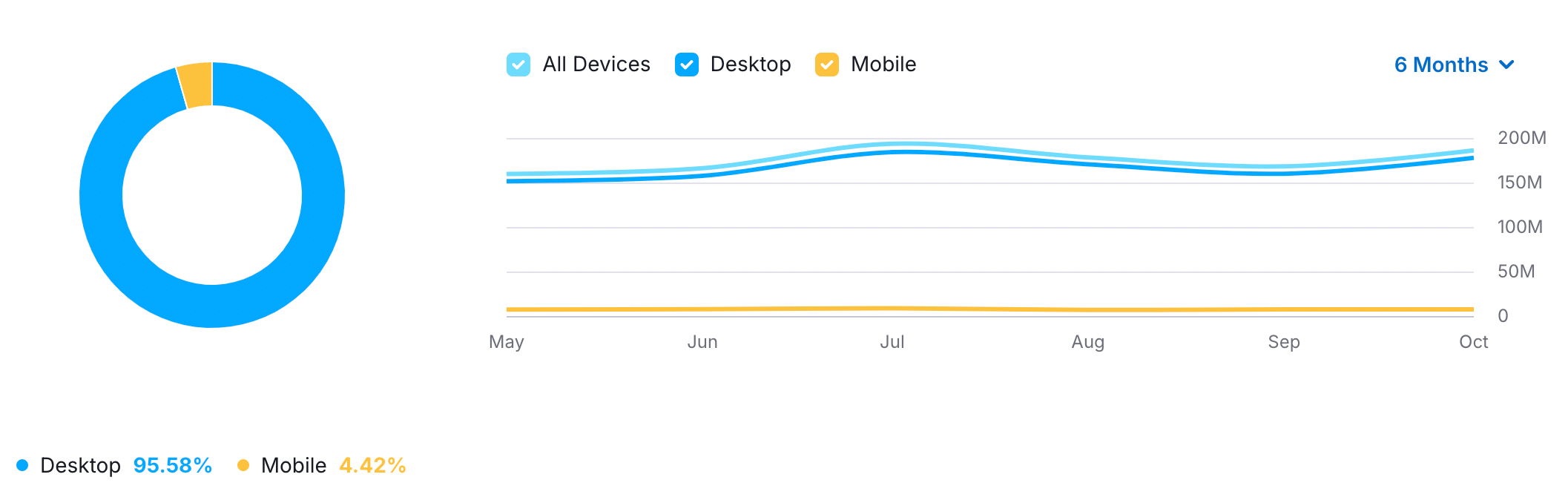

As of October 2024, the vast majority of visits to Slack come from desktop computers, accounting for 95.58% of traffic, while only 4.42% of users access the site through mobile devices.

Slack’s financial performance and revenue

Slack’s financial performance is key information for anyone seeking a fuller picture of this tool. The three sections below highlight the current Slack revenue and growth trends, key acquisitions, and revenue breakdowns across different segments.

Revenue growth trends

How has Slack’s revenue grown over the years? Here are a few key numbers you should be aware of.

Slack was the fastest-ever startup to achieve a $1 billion valuation when it launched in 2013.

According to a report by GP Bullhound, Slack quickly reached an Annual Recurring Revenue of $10 million in just a few months since its launch.

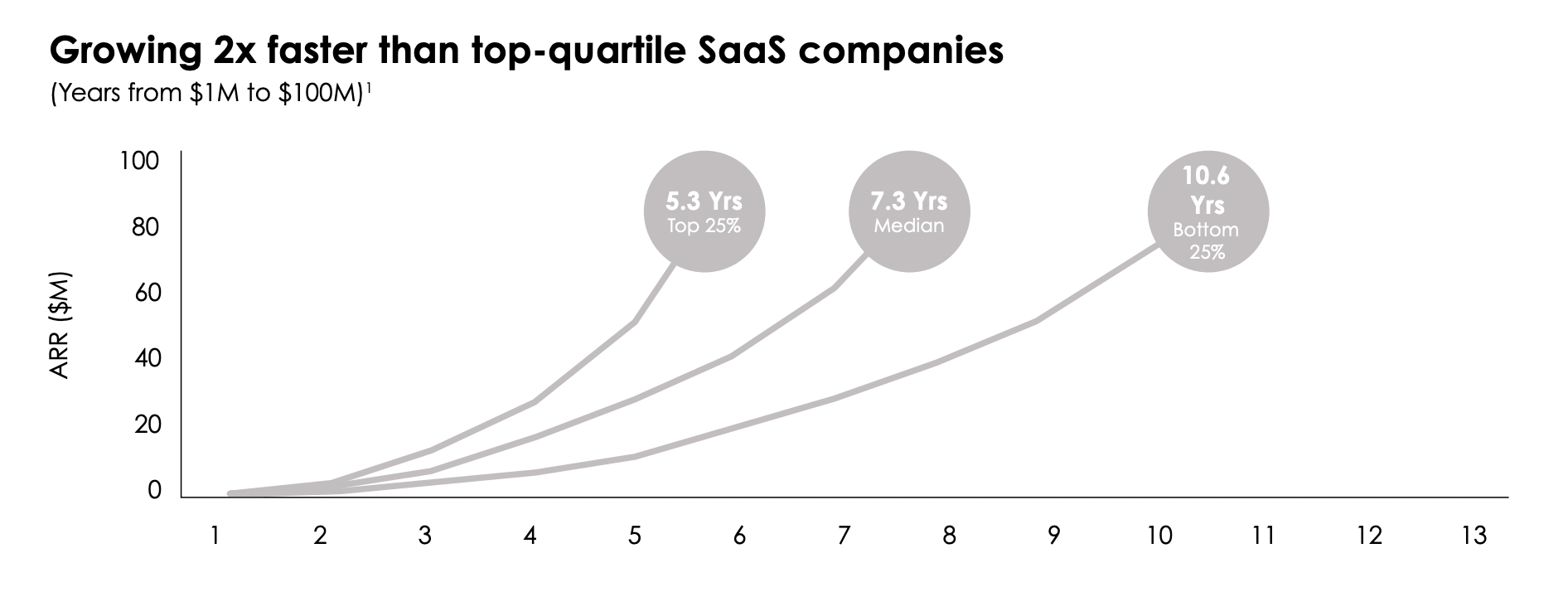

In fact, SaaS companies take an average of 7.3 years to go from $0 to $100 million ARR. The top quartile files typically reach this milestone in 5.3 years. Slack, however, achieved this in less than three years.

It generated revenue worth $100 million in less than three years and, by 2019, had generated $400+ million, making it one of the fastest-growing SaaS companies.

Bullhound predicts that Slack's revenue will reach $4.2 billion by 2025 and maintain a 25% share of the total enterprise productivity market.

Sources: GP Bullhound

Sources: GP Bullhound

Valuation and acquisitions

What is the current Slack valuation, and has it made any acquisitions in the past? The data points below offer all the information you need.

By October 2018, Slack had achieved a valuation of $7.1 billion.

In fact, GP Bullhound believes Slack could be valued at over $50 billion by 2025.

As per Tracxn, Slack made eight acquisitions, with 2018 being its busiest year with four.

On 21 July 2021, Slack also announced that Salesforce had completed its acquisition of Slack.

Sources: GP Bullhound, Tracxn, Slack

Revenue breakdown by segment

Regarding geographic location, Slack’s revenue comes from the United States and internationally. As of Q1 2022, Slack’s revenue share from the United States stood at 59.97%, and its international share was 40.03%.

In the US, Slack is used by a mix of small organizations and some of the most notable enterprises. These include Uber, Benefit Cosmetics, Netflix, Survey Monkey, Expedia, and Autodesk.

Internationally, some of the organizations that use Slack include HelloFresh, Shopify, Culture Amp, and Tyro Payments.

Sources: Business Quant

Slack’s user engagement statistics

Mapping Slack’s user engagement is key to understanding its pivotal role in modern workplaces, particularly after the COVID-19 pandemic when remote or hybrid work has become the norm across several industries. The two sections below offer some crucial insights.

Messages sent daily

How many do users send daily on Slack? Here is what you need to know:

Five billion actions are completed every week, including commenting on documents, sending messages, and building custom apps.

More than 1 billion of these actions happen on a mobile device every single week.

Sources: Slack

Average time spent on Slack

How much time do users spend on Slack on average? Here are the numbers:

Twelve million users spend about 90 minutes working on Slack daily.

In fact, Slack is so critical to ensuring efficient workplace communication that 70% of workers say that its availability would be a key factor in evaluating a job offer.

Among those who use Slack at their workplaces, 77% describe their organizations as more transparent, compared to 55% of non-Slack users. This is critical, as employees today demand that organizations remain transparent about key decisions and structural changes that impact them.

Slack usage by industry and company size

Which industries use Slack the most, and what size companies prefer using this tool to streamline workplace communication? The statistics listed in the two sections below offer some key insights.

Industry adoption rates

This section highlights the various industries that have adopted Slack as their workplace communication solution and why they prefer it over other tools.

As of 2019, 65 of the Fortune 100 companies were using Slack.

According to Slack’s website, in addition to larger organizations, other professionals who were using the tool include accountants, dentists, chefs, journalists, engineers, lawyers, and more.

Slack is used to coordinate election coverage, diagnose network problems, plan marketing campaigns, approve menus, review candidates for jobs, and so on.

Usage by company size

The statistics in this section highlight the size of organizations in which Slack is more popular.

Slack benefits both small and large businesses. According to data on its website, using Slack has led to a 338% ROI, while 85% say that this tool has improved communication. Additionally, it has resulted in $2.1 million in productivity savings.

Sources: Slack

Slack’s market position and competitors

Slack is one of many workplace communication tools on the market. However, it is crucial to know how it compares with these tools and what share of the market it captures. The next two sections offer some key insights.

Market share compared to competitors

How does Slack's market share compared with that of its competitors? Here’s what you need to know.

According to a 2022 survey of working professionals, around 60% of respondents used workplace collaboration tools like Microsoft Teams and Slack.

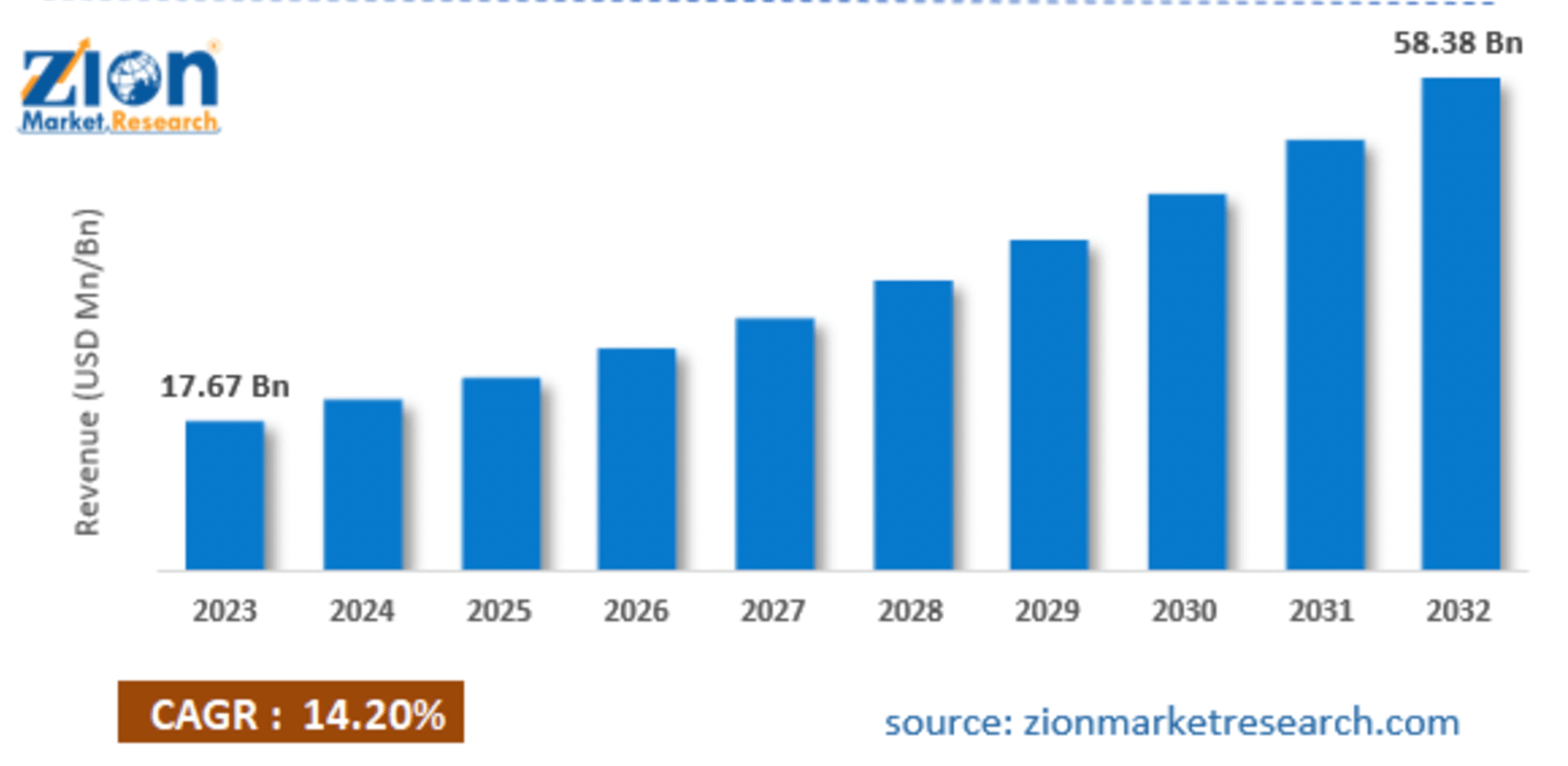

According to Zion Market Research, the market for remote team communication tools was valued at $17.67 billion in 2023 and is forecasted to grow to about $58.38 billion by 2032.

According to 6Sense, Slack’s current market share is 18.54%, with 344,940 customers.

Its top three competitors are WhatsApp Business, with a market share of 32.11%; Microsoft Office 365, with a share of 20.41%; and Intercom, with a share of 6%.

Sources: Statista, Zion Market Research, 6Sense

Sources: Statista, Zion Market Research, 6Sense

Slack’s unique features and competitive advantage

What unique features does Slack have that give it an advantage over its competitors? Here are a few key insights.

According to an analysis by VLink, Slack offers a host of features that give it a strong competitive advantage. These include customizable notification settings, advanced search functionality that spans the entire interface, contextually relevant and segmented communication, seamless communication across devices, integration with over 2,600 productivity and other professional applications, and more.

Other features include advanced DND settings, the ability to schedule messages, custom responses, hiding channels with zero messages, and so on.

Salesforce’s acquisition of Slack also offers customers a seamless integration of a communication tool like Slack with a comprehensive CRM.

Sources: VLink

The bottom line

Over the years, Slack has become critical to ensuring seamless communication at workplaces worldwide. These Slack statistics offer key insights into its market position, usage, and more. When you host a meeting via Slack, documenting every action item becomes critical. An AI notetaker like Notta can be an ideal solution for this purpose.

Sources:

Sources: