40+ Temu Statistics for 2025: Users, Revenue & Growth

Record, transcribe and summarize conversations with one click.

Launched in 2022, Chinese-owned Temu has turned into one of the biggest online shopping platforms in a very short span of time. As a result, it makes for an interesting case study that I’ve been studying ever since its rise to prominence. Its gamified shopping experience and marketing investments are some of its key highlights. In this guide, I’ve listed 40+ Temu statistics you should know about for 2025. They cover its user base, revenue, market share, and more.

Temu stats (top picks)

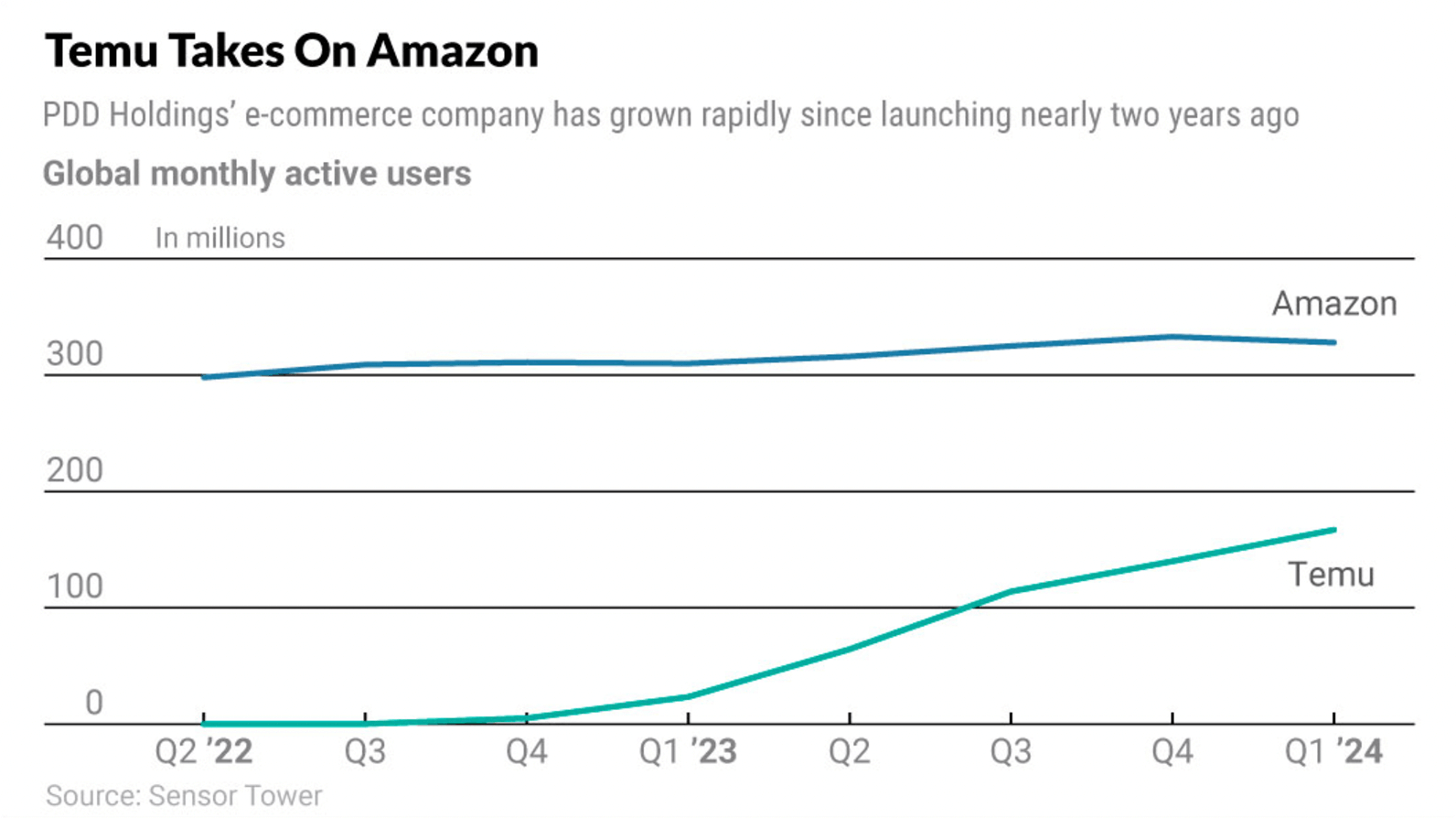

Temu was launched in 2022 on the same model as Amazon but had quickly reached 167 million monthly active users on its mobile app as of Q1 2024.

As of April 2024, 20.59% of the visitors to Temu’s website were from those between the ages of 35 and 44.

Temu had captured a 17% share of the US e-commerce market as of April 2024.

Users spent an average of 18 minutes on the Temu mobile app as of the second quarter of 2023.

In comparison, users spent an average of 11 minutes on AliExpress and 10 minutes on Amazon.

Overview of Temu’s market position

The first two sections in this guide cover a brief history of Temu, how it started, and how it differentiates itself from other competitors in the market.

A brief history of Temu

Temu was launched in 2022 and is an online marketplace that works on the same model as Amazon. It sells products sold by individual third-party sellers. One of the key highlights of its website is that it sells a wide range of products at very low prices, which is one of the reasons for its immense popularity in such a short time.

Besides the low prices, you also get ads that offer additional discounts on these products. The company was founded in Boston, Massachusetts, and is owned by Chinese-based PDD Holdings. Its tagline, “Shop Like a Billionaire,” gives customers a worry-free experience as their purchases are bound to be cheap, allowing them to buy more than they otherwise would.

Sources: Temu

Temu vs. competitors

Temu has certain pros that set it apart from key competitors like Amazon. For example, while Amazon has a vast collection of tech and tech accessories, the prices at which Temu sells them are unbeatable. This is also because Temu eliminates intermediaries, allowing customers to buy products at much cheaper prices.

Temu’s cheap prices are also ideal for those willing to experiment with dupes. However, the downside with these is that you could often end up with products that are not as high-quality or that don’t match the description shown on the website.

User statistics on Temu

The statistics in the three sections tell you everything you need to know about Temu’s active user base, demographics, and geographic distribution.

Monthly active users and growth trends

How many people use Temu? In a short time, Temu has garnered a large audience of shoppers who routinely use the platform for budget purchases. Here are a few key insights about its monthly active users and how these numbers have grown since 2022.

In the first quarter of 2024, Temu’s mobile app had 167 million monthly active users, a 614% year-over-year increase.

In fact, according to Sensor Tower, Temu’s monthly active users on Google Play in 2023 even surpassed apps like Shein. Even in June 2023, it had 16 million monthly active users on Google Play, more than double that of Shien’s MAU.

By Q1 2024, monthly active users in the US alone were up 134%.

In October 2024 alone, Temu was downloaded a whopping 12 million times.

Sources: Investors Business Daily, Sensor Tower, Sensor Tower

Sources: Investors Business Daily, Sensor Tower, Sensor Tower

User demographics

What are the demographics of the visitors to Temu’s app and website? Here’s everything you need to know.

As of April 2024, about 20.59% of the visitors to Temu’s website were from those between the ages of 35 and 44.

Another 20.6% were those between the ages of 25 and 34.

In total, by April 2024, Temu had 503.3 million visits.

Sources: Statista

Geographic distribution of users

This section tells you everything you need to know about the geographic distribution of Temu’s users.

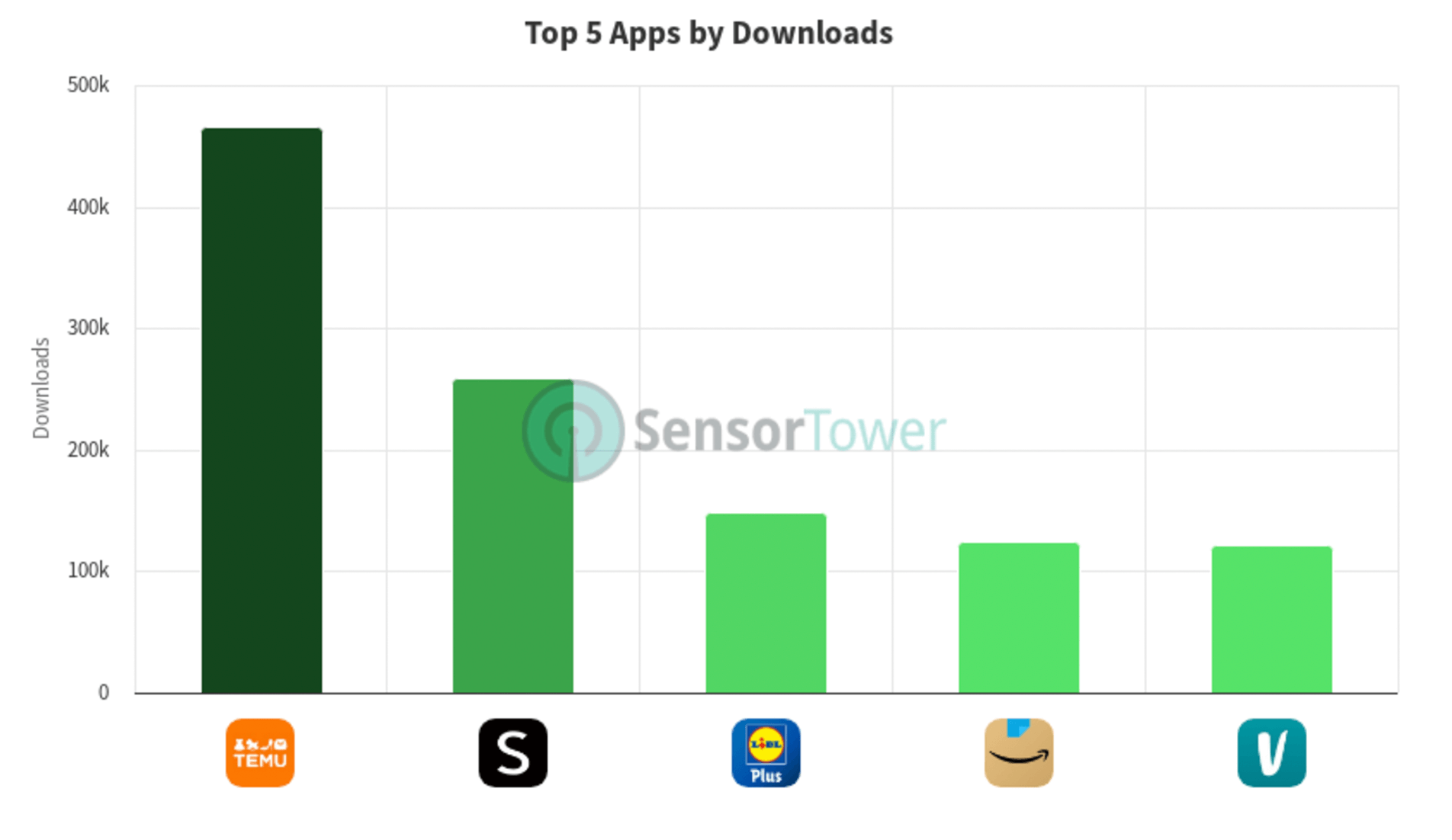

According to Sensor Tower data, Temu saw a fluctuating pattern in downloads but was still the most downloaded shopping and e-commerce app in the US. It beat other major players such as Shein and Amazon.

Temu started the quarter with 42,000 downloads and reached a spike of 49,000. Weekly active users increased from 549,000 in the first week of Q2 2024 to 676,000 by the end of June.

Temu has become the most popular shopping app in countries like the United States, where inflation-wary customers have found a liking for the cheaper alternatives Temu provides to Amazon. It has also become immensely popular among young people in Mexico.

In 2023, Temu achieved its first milestone: over 123 million monthly active users in the United States alone.

Sources: Sensor Tower, Statista

Sources: Sensor Tower, Statista

Financial statistics for Temu

Temu’s parent company, Pinduoduo, has seen a steady increase in profits. While Pinduoduo itself was founded in 2015, Temu was founded and launched much later in 2022. The three sections below tell you everything you need to know about Temu’s revenue and financial status.

Revenue and revenue growth rate

Here’s everything you need to know about Temu’s revenue and annual growth rate.

Pinduoduo went viral among small-town youths for its extremely low prices and cashback options. It even offered lower prices compared to Alibaba and JD.com.

Today, it is also among the world’s top 10 online retailers. In 2023, Pinduoduo generated revenue of 247.64 yuan, a staggering increase from the 130.56 billion yuan it generated in 2022.

Sources: Statista

Market valuation and investor interest

What is Temu and its parent company valued for 2024, and which are its key investors? Here are a few interesting insights.

As of early October 2024, PDD Holdings was valued at $211 billion. However, its market cap has fallen to $145.11 billion as of December 10, 2024.

In May 2023, Temu generated a Gross Merchandise Value (GSV) of approximately $635 million. This was a drastic increase over its GSV from September 2022, which stood at just $3 million.

Sources: Stock Analysis, Statista

Revenue breakdown by category

How does Temu or its parent company’s revenue stack up based on its various segments? Here is a quick breakdown.

In 2023, PDD Holdings generated a revenue of approximately 153.54 billion yuan from online marketing services and others.

It further generated 94.1 billion yuan from transaction services.

Online marketing services and others were the company's primary sources of revenue. However, transaction services have been increasingly critical.

Sources: Statista

Notta offers the most integrated AI meeting notes, summaries, and action items so nothing gets missed.

Temu’s market share and competitive landscape

Despite being a Chinese company, Temu’s increasing popularity, particularly in the US and Mexico, has given it a significant advantage over its competitors. Here’s everything you need to know about Temu’s market share and the key differentiators in its strategy.

Temu’s share of the e-commerce market

As of April 2024, Temu had captured a 17% share of the US e-commerce market, posing significant challenges for American players like Amazon, Dollar Tree, and Five Below. Temu also became the #1 shopping app on the App Store, surpassing Amazon, Walmart, and Target. Shien held the second spot, resulting in Chinese players holding the top two positions.

Sources: Yahoo Finance

Key differentiators in Temu’s strategy

While Amazon is known for its quick delivery times, Temu also focuses on providing low prices across the board with additional discounts above them. Additionally, its free and fast shopping has also made people across the world, even in America, rely on it for their shopping needs a lot more than platforms like Target and Amazon.

According to Margin Business, Temu also employs a model that directly connects the manufacturer with the seller, eliminating several middlemen in the process. This leads to reduced commissions and, ultimately, lower prices.

Additionally, while Amazon’s USPs are reliable and fast shopping, Temu’s core focus is on lower prices, which is a big draw for those dealing with high global inflation rates. Another key aspect that differentiates it from its competitors is group buying, where friends who shop together get even greater discounts.

Sources: Margin Business

User engagement and behavioral statistics

How much time do users spend on the Temu website on average, and which are the most popular categories? The sections below provide everything you need to know.

Average time spent and activity per user

According to Bloomberg, shoppers spend twice as much time on Temu as on other e-commerce platforms.

In Q2 2023, users spent an average of 18 minutes on the Temu mobile app.

In comparison, shoppers spent 11 minutes on average on AliExpress and 10 minutes on Amazon.

Sources: Bloomberg

Most popular product categories

Which are the most popular product categories on Temu? Here are some key insights:

Based on an analysis of the top trending products in the United States, some of the most popular categories on Temu include fashion, footwear, and accessories.

Sources: Temu

Temu’s impact on e-commerce trends

What impact has Temu had on the e-commerce market and on trends within the industry? The next two sections tell you everything you need to know.

Innovations in user experience and logistics

What innovations has Temu pioneered in terms of user experience and logistics? To start off, Temu partnered with major carriers like UPS, FedEx, and so on to ensure the seamless delivery of products. They also partner with third-party logistics providers to optimize freight costs by cooperating with freight forwarding companies.

This strategy helps support the company’s global expansion and allows it to enter markets like Spain and Portugal through deals with local services. Temu’s supply chain strategies have also pushed Amazon to revisit its supply chains to help reduce commodity prices for the end user.

Sources: Jusda Global

Influence on pricing and competitive dynamics

Temu’s supply-centric model, group buying, and heavily discounted shipping have led and will lead platforms like Amazon to revisit their pricing strategies. Additionally, an analysis by Margin Business also says that Amazon will have to revisit its supply chain operations and expand into similar business models to compete with Temu’s success in some of the former’s biggest markets.

Sources: Margin Business

The bottom line

Temu has quickly grown into one of the biggest e-commerce platforms. This guide has listed 40+ Temu statistics that offer insights into every aspect of the company. Documenting all your strategy sessions is key for sellers or people marketing their products on Temu. An AI notetaker like Notta can help you do this with impressive accuracy.